From Margot Paez, host of The Progressive Bitcoiner podcast

The new Trump administration’s Ways and Means Committee has unveiled a set of budget proposals that could reshape America. If you’re a progressive who also supports Bitcoin, this moment calls for nuanced reflection. These recently leaked proposals touch on critical issues that matter deeply to us: equity, sustainability, financial sovereignty, and decentralization. While Bitcoin has always been about disrupting the status quo, we must examine how these proposed changes align with or challenge the ideals we hold dear.

Social Safety Nets: A Question of Equity

Bitcoin’s decentralized ethos emphasizes self-reliance, but a just society also supports those in need. The budget’s push to codify the Chained CPI-U for federal poverty programs would reduce inflation-adjusted benefits over time, saving $5 billion. For progressives, this raises red flags. Slowing benefit growth risks leaving low-income families even further behind as costs rise—a far cry from the inclusive financial future Bitcoin envisions.

Similarly, the elimination of the Social Services Block Grant (SSBG) and a 10% cut to TANF block grants signal a retreat from social responsibility. The SSBG supports child care, elder care, and services that empower struggling families. As Bitcoiners, we champion financial sovereignty—but can we truly achieve it if foundational safety nets are removed?

Education: Freedom or Barriers?

Bitcoin unlocks financial empowerment through decentralized technology, yet education is the first step toward self-determination. The proposed budget’s repeal of the Biden administration’s “SAVE” plan and simplification of income-driven repayment structures would save $127.3 billion. However, these changes could mean higher monthly payments for borrowers, particularly those from disadvantaged backgrounds.

The elimination of tax credits like the American Opportunity and Lifetime Learning Credits, along with a phase-out of Grad and Parent PLUS loans, threatens access to higher education. Without education, how can we equip the next generation to thrive in the decentralized, digital economy Bitcoin is building?

Healthcare: Decentralization Meets Public Good

Bitcoiners often question centralized systems, but healthcare is a domain where decentralization must be balanced with public good. Limiting federal healthcare program eligibility based on citizenship status saves $35 billion but risks worsening public health outcomes. Similarly, ending Medicare bad debt coverage and repealing nursing home staffing rules may reduce federal expenditures, but they also threaten care quality for the most vulnerable.

Healthcare, like Bitcoin, should empower individuals. But empowerment must include access to quality care. Cutting these programs disproportionately harms those who are already marginalized—a betrayal of the equitable future we strive for.

Climate Change and Green Energy: Where Vision Meets Reality

The proposed budget’s repeal of green energy tax credits and Inflation Reduction Act (IRA) funding for renewable energy programs would save over $1 trillion. Yet this move undermines one of the most pressing challenges of our time: the green energy transition. Bitcoin mining, increasingly powered by renewable energy, has already shown how decentralized systems can drive sustainable innovation. Repealing these incentives could stall this momentum.

The rollback of EPA tailpipe emissions standards and reductions in conservation program funding further exacerbate environmental concerns. Bitcoiners understand the power of incentives. Just as miners respond to hashprice signals, governments must incentivize renewable energy adoption to protect our shared future.

Federal Oversight: Striking the Right Balance

Bitcoin thrives on reducing centralized control, so proposals to eliminate mandatory funding for the Consumer Financial Protection Bureau (CFPB) and the Office of Financial Research (OFR) may seem appealing at first glance. These moves would save $10 billion over a decade and increase congressional oversight.

However, decentralization should not mean deregulation. The CFPB protects individuals from predatory practices, a mission that aligns with Bitcoin’s promise of financial fairness. Weakening these safeguards risks increasing inequality in a system we aim to reform.

Middle Class and Tax Policies: Protecting the Backbone

Bitcoin empowers individuals to take control of their wealth. Yet tax policies that disproportionately harm the middle class threaten the economic empowerment Bitcoiners champion. Eliminating the SALT deduction and home mortgage interest deduction would save $2 trillion but increase financial burdens for middle-class families in high-tax states.

Meanwhile, removing the Child and Dependent Care Credit undermines working families who rely on affordable childcare. For Bitcoin to serve as a tool of liberation, we must advocate for policies that empower, not punish, the middle class.

Federal Lands and Natural Resources: Protecting Our Shared Heritage

The Bitcoin ethos respects property rights, but federal lands are a collective resource—a commons that must be protected. Proposals to reopen Arctic National Wildlife Refuge (ANWR) leasing and sell federal lands aim to generate revenue, but they risk long-term ecological harm. These actions are short-term solutions that contradict Bitcoin’s forward-thinking philosophy.

Expanding geothermal leasing offers a more sustainable path. Geothermal energy aligns with Bitcoin mining’s increasing reliance on renewables, demonstrating how innovation can coexist with conservation.

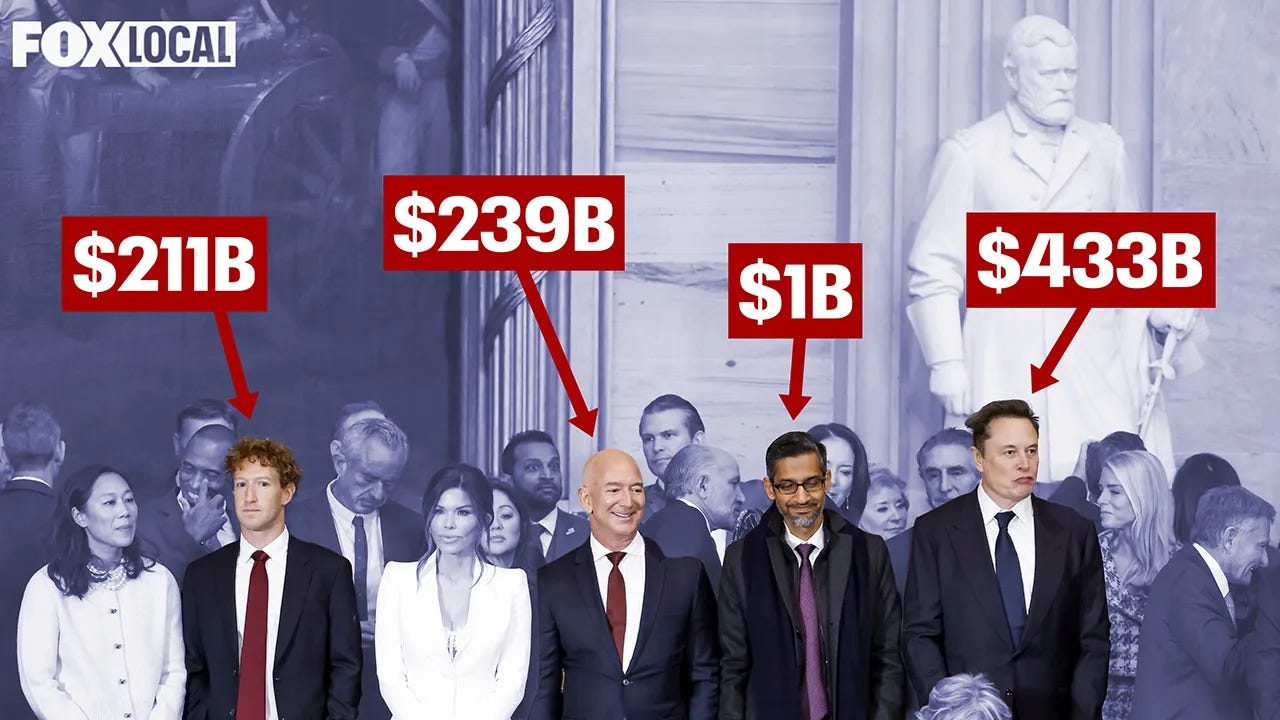

Corporations and Big Business: Decentralization vs. Concentration

Lowering the corporate tax rate to 15% and repealing the corporate alternative minimum tax (AMT) may spur economic activity, but these changes overwhelmingly benefit large corporations. Bitcoin’s decentralized model thrives on empowering small, independent actors, not consolidating wealth among the few.

Taxing nonprofit hospitals as for-profit entities may boost federal revenue, but it risks harming community healthcare. For Bitcoiners, the question is clear: Are we building a system that benefits everyone or perpetuating the same inequities we seek to escape?

Conclusion: A Call to Action

As progressive Bitcoiners, we stand at the intersection of financial sovereignty and social justice. The proposed budget changes challenge us to consider how our values align with the future being charted. While decentralization offers a path to empowerment, it must be coupled with policies that promote equity, sustainability, and opportunity for all.

Bitcoin’s promise is a system that works for everyone. Let’s hold our leaders accountable to that vision. The time to engage is now.

For more information, you can see the original Senate memo at senate.gov and also read through our breakdown of the key issues here.